Pocket Option OTC: A Comprehensive Guide to Trading

The financial markets offer a plethora of opportunities for both novice and expert traders. One such opportunity is Pocket Option OTC, a trading platform that has gained popularity for its innovative approach to over-the-counter (OTC) trading. In this article, we will delve into the intricacies of Pocket Option OTC, discussing its advantages, strategies, and the potential it holds for traders looking to diversify their trading portfolio.

Understanding OTC Trading

Over-the-counter (OTC) trading refers to the process of trading financial instruments directly between two parties, without the supervision of an exchange. The OTC market is decentralized and allows for a more flexible and accessible approach to trading, often providing opportunities that are not available on traditional exchanges. This type of trading can involve a wide range of assets, including stocks, commodities, currencies, and derivatives.

The Rise of Pocket Option OTC

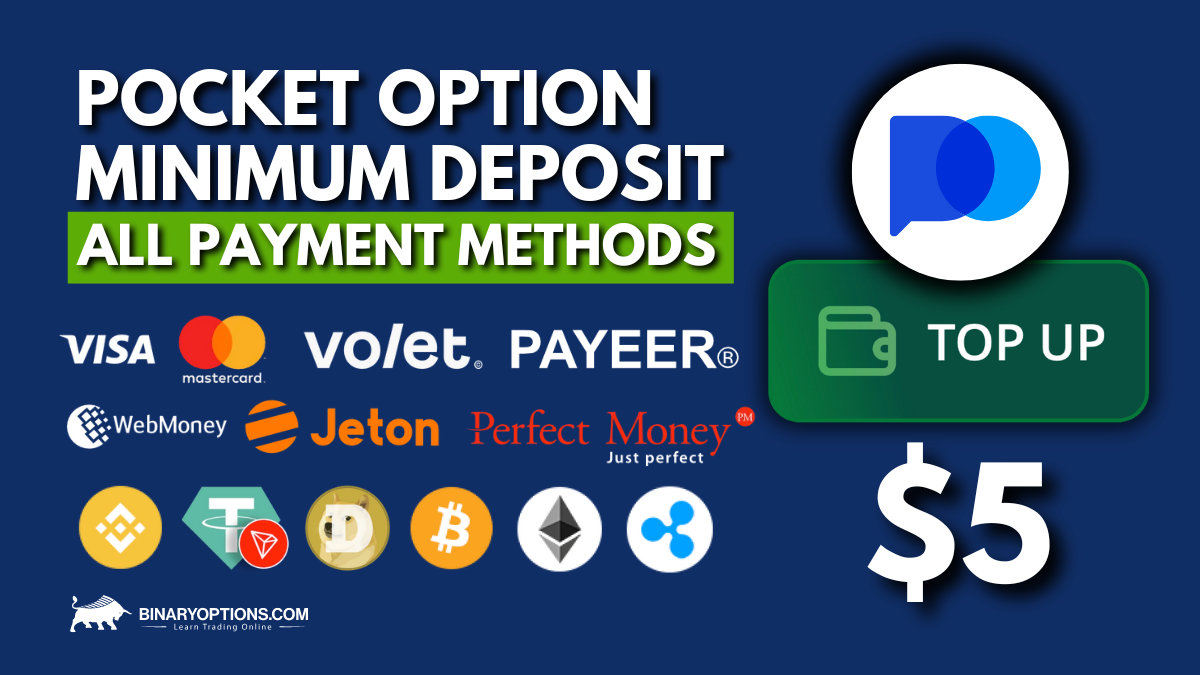

Pocket Option OTC has become a popular choice for traders seeking to exploit the benefits of OTC trading. As a platform, it offers a user-friendly interface that caters to both beginners and experienced traders. One of the key advantages of Pocket Option OTC is its accessibility. The platform is available worldwide, providing traders with the ability to trade on a global scale with minimal restrictions.

Benefits of Trading on Pocket Option OTC

1. **Diverse Trading Opportunities**: Pocket Option OTC supports a wide range of asset classes, allowing traders to explore various markets and enhance their trading strategies.

2. **Increased Privacy and Security**: Trading OTC can offer greater privacy since transactions are conducted directly between parties. Pocket Option OTC employs advanced security measures to protect user data and funds.

3. **Flexible Trading Hours**: Unlike traditional exchanges bound by set trading hours, OTC markets often operate 24/7. This flexibility allows traders to engage in trading activities beyond regular market hours, accommodating different time zones and personal schedules.

Effective Strategies for Pocket Option OTC Trading

Developing a robust trading strategy is crucial for success in the OTC market. Here are some effective strategies that can be utilized on Pocket Option OTC:

– **Technical Analysis**: Utilize charts, patterns, and technical indicators to identify potential entry and exit points. Understanding technical analysis can enhance your ability to make informed decisions.

– **Risk Management**: Implementing risk management strategies, such as setting stop-loss and take-profit levels, helps mitigate potential losses and protects your capital.

– **Diversification**: Spread investments across different asset classes offered by Pocket Option OTC. Diversification can help reduce risk and improve potential returns.

– **Stay Informed**: Keep abreast of news and developments that could impact the assets you are trading. A well-informed trader is better equipped to anticipate market movements.

Potential Challenges and Considerations

While Pocket Option OTC offers numerous advantages, it’s important to be aware of potential challenges and considerations. The decentralized nature of OTC trading can sometimes result in less transparency and price discrepancies, requiring traders to exercise due diligence and caution.

Moreover, given the over-the-counter nature of the platform, liquidity might vary compared to traditional exchanges. Traders should be prepared for potentially wider spreads and lower liquidity in less popular assets.

Conclusion

Pocket Option OTC presents a unique and promising avenue for traders seeking flexible, diverse, and accessible trading opportunities. By understanding the nuances and intricacies of OTC trading, traders can capitalize on the benefits offered by this platform. However, as with any form of trading, it’s crucial to approach it with a solid strategy, rigorous risk management, and continuous learning to navigate the dynamic realm of financial markets effectively.